FutureCard Review

Background

FutureCard is a high-reward debit card with a focus on sustainability, but it doesn’t mean you have to be the most eco-friendly and green to take advantage of this weirdly good card. I’m a pretty standard credit card churner. I open a couple new cards for the sign up bonuses (SUBs) a year. I know which categories for which cards get the most points, I try to get at least 2%+ back on every dollar spent and I like to find a way to redeem the points for at least 1 cent per, aiming for higher. I’m a big fan of no annual fee credit cards, as the math behind annual fee credit cards becomes much more difficult, especially after the SUB. Some good staples to have in your wallet are the Chase Freedom and Bank of America Customized Cash Rewards, both of which feature rotaing categories quarterly / monthly respectively for 5% back. Then you should have a standard 2% back card on everything, both Wells Fargo Active Cash and CitiBank Double Cash offer that.

But back to the FutureCard itself.

Pros

Debit Card

This isn’t a credit card so there isn’t an interest rate on your balance because there can be no credit taken. Low risk for anyone who is worried about that aspect of rewards cards.

Interest on Balance

In fact they give you interest on your balance that you keep in the card. This is a new feature they’ve added in the past couple months. 4.10% APY interest, which is pretty darn good all things considered. Makes it really easy to just add money to the account and not worry about it.

5% back on multiple categories

MTA

Utilities

Thrift and Secondhand

Plant-based Food & Restaurants (like Just Salad, Chopt, Sweetgreen, and PLNT Burger)

Sustainable Beauty and Fashion

Even more on other categories (that I personally don’t use)

EV Charging - 10%

Bike Shops - 10%

Community Solar - 10%

Newly Added Ongoing Promotions

Revolving cycle of offers like increased cashback on:

Metro North, LIRR, NJT, and Amtrak

Groceries

Cafes and Plant-based Food & Restaurants

Great Rewards that are undervalued

Tickets, gift cards, memberships etc.

Cash redemption at a solid 1:1

Having a solid redemption for cash makes its baseline pretty safe.

Customer Service

They have always responded and are very friendly to all of my inquiries.

Exposure to Sustainable Companies

I learn of new and upcoming sustainable companies and concepts, and get to test them out often with a little financial incentive. Companies like Back Market and Nuuly have been featured in the past with pretty nice deals.

Cons

Janky app

The app has some issues and can be a bit buggy, but works overall.

Debit Card

You only have the money you put in, so that can be frustrating if you get somewhere and you need to pay, it’s not exactly the moment to try and get some funds transferred in, especially when it takes 1-3 business days. So you have to be proactive and prepared for what you may want to spend on.

Highly Manual

Redeeming rewards like the two aforementioned ones meant emailing back and forth with customer support to get my reward. Unlike most other credit card rewards which are automated, this is a manual and can have a significant multiday time delay on receiving the rewards. Receiving the Hans Zimmer tickets took 17 hours, albeit I ordered on a Sunday and their office only opens for standard weekday business hours, so it is when I expected it to go through, but something to keep in mind. Bathhouse’s redemption gift card took nearly 90 hours to deliver.

Customer Service

It can be slow and there is no live chat function.

Still Trying to Figure Themselves Out

For awhile they focused on you doing missions that would be measured in CO2e and you would earn coins for every 1,000 kilograms you would save. But they recently just ended this program.

They started a promotion that said once a week between Monday through Sunday, then changed it in the second week to be a rolling 7 day period, which threw off my efforts.

No Transfer Partners

I mean it makes sense, but the redemption options are quite limited.

My Experience

I joined April, 2023. Over the nearly two years I’ve had it, I mostly have only used it for the subway. A 30 day pass is $132, and you’d be getting $6.60 back at 5%. In reality though, with OMNY now in full swing and the 7 day auto cap I can be much more efficient about it, and I never do the 30 day pass. It helps that I have a flexible hybrid schedule. So personal estimated math on just this main category is that I took about 400 subway rides in 2024 (sort of, I capped counting when I maxed out the 7 day cap). And I maxed out 7 day caps of 13 rides 20 times. By doing so, FutureCard gives you a $5 bonus. So the rough math here is I spent $1,160 on the subway, on FutureCard. They gave me around $100 in bonuses and $58 in 5% back rewards; for a total of $158, and a net spend of $1,002. Now this is already biased because I didn’t track the number of trips that were fully comped by FutureCard. They have random free subway days, weeks, promotions, etc. So there are even more savings in there. I’d estimate my subway savings for 2024 at somewhere between $200-$250 (an additional 17-35 rides).

For example, this January, 2025, they just gave me a month of free subway rides… so… that’s probably $100 worth of savings to start the year off.

There are other 5% categories. Most notably utilities, but also for the next few months, groceries. This is probably $60 for the utilities and $100 for groceries in rewards for this year. Who knows what else they’ll add or rotate in too.

With the Points in the app you can redeem them 1:1 for cash, which is a solid redemption. But there is some extra value in the other Rewards you can get. I’ve done three, and they’re all very good deals.

Hans Zimmer

$20 for two tickets to his concert in Baltimore. Because I already had tickets to Brooklyn, I knew the value of these, and I snagged them immediately. I resold them for $245 (post reselling fees and below both the tax threshold and market value, and considering I paid $168.65 per ticket myself for significantly worse seats, I was giving someone a pretty good deal and don’t feel bad about reselling them). I mean that’s technically 12.25 cents per point, though yes, I didn’t know how much I would actually get for the tickets when I redeemed them. They quickly ran out of these tickets, so don’t expect this sort of arbitrage very often.

Bathhouse

$80 in points for a gift card worth $209… that’s a redemption value of 2.61 cents per point. Way better than the cash redemption.

CitiBike

$150 in points for an annual membership worth $220. That’s a redemption value of 1.47 cents per point. Also way better than the cash redemption.

With these three arbitrage opportunities. I saved / made $424. I personally was going to spend on the latter two anyway, so these were actually net benefits.

Add to that the promotions they run. There’s the $5 back at a cafe weekly for 3 weeks, and $5 back at a salad place for 3 weeks. $5 for TooGoodToGo, etc. I’ve taken advantage of a lot of these. I’ll estimate $20 of net savings, because technically I probably spent more money than I would have. These promotions forcing spending is certainly a negative as well.

So my quick and dirty math here is that this no annual fee card has earned / saved me in the last 12 months probably $850. I mean… that’s ridiculous value for a no-fee card.

Who Should Get This Card / Final Verdict

This card is a must for anyone who lives in New York (or one of the other cities that has both reliable public transportation and is supported by FutureCard) and doesn’t pay for it through another program like pre-tax commuter benefits or student discounted rates. With that as the base, you’ll find that the rest of the card to be situationally valuable and with the 4.10% APY interest, there’s no reason not to keep a healthy amount of funds in the app to maintain its functionality without paying for immediate fund transfers.

Update as of 8/8/25

It should be noted that since I posted this earlier this year, I’ve noticed a significant decline in value from this card. It’s still solid for the same reasons as above, but it’s certainly taken a turn. Here are some of the negatives that have occurred over the last six months:

Rewards in general have dropped in value and usefulness:

I have yet to see a reward for an event like concerts at CFG Arena in Baltimore since the Hans Zimmer one.

The CitiBike membership used to be $150 in points and it is now $190. That’s a 20% decrease in value.

The Bathhouse gift cards have disappeared and they were previously there for a long time.

Generally I’ve seen fewer reward options.

Earning bonus points for promotions has become much harder:

The $5 bonuses at salad restaurants, TooGoodToGo, and cafes used to be just if you spent $10. Now you have to spend $25 within a timeframe (TooGoodToGo’s is a $50 target before it triggers). That means multiple visits within the timeframe. Much harder to attain and a lot less value.

The only new positive is that they extended the groceries at 5% promotion for another two months.

Update as of 8/21/25

This was bothering me a lot. I’m an iPhone user and have FutureCard linked to my Apple Pay Wallet. Quick double click and I can pay at the OMNY turnstiles for the MTA. However, I was getting some random other cards paying for it every so often, usually when I was in a rush, and it would greatly annoy me. Irk me the whole subway ride. I couldn’t figure out why, I had my FutureCard as the default card, and it should be always paying unless I specifically pick something else. I was troubleshooting and looking around and nothing showed up as to what could be the problem. But today, I found the setting. Go to iPhone Settings, then go to Wallet & Apple Pay, if you scroll down past the cards and accounts, there’s a section called Express Transit Card. Make sure this is set for FutureCard to make sure your subway payments are always placed to the correct account. Mine was automatically being set to the newest card I added, and that kept throwing it off. It only affected it rarely, and usually when I was in a hurry and not paying attention. Hopefully this resolves it in the future.

Update as of 9/22/25

It’s disappointing, but basically, since I posted this article earlier this year, I haven’t seen a great new redemption offer for the ClimatePoints. Still a 1:1 for cash back isn’t bad, so I will still advocate for the card, but it’s sad that they’ve seemed to stall releasing new redemption options.

In the interest of transparency, I have gotten five referrals for a total of $75 back from this post over the course of 7 months. I appreciate everyone’s support!

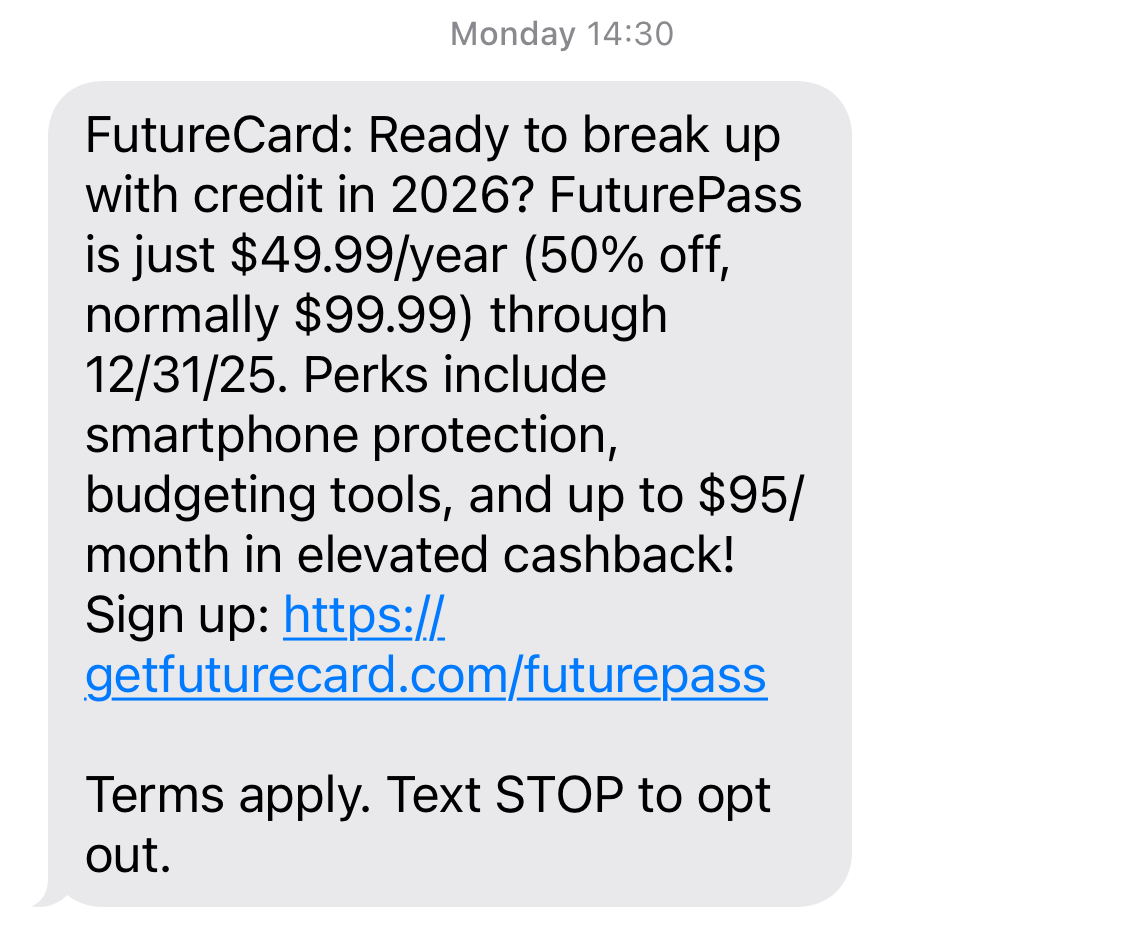

Major Update as of 11/20/25

I officially no longer recommend this card. The final straw was the introduction of FuturePass, a paid version of FutureCard. The paid version then costs $100 a year. Most notably:

The 4.10% APY for all cash in the debit card is not only 3% for paid and 0% for free…

$5 weekly 10-ride public transit bonus is now gone for the free version

Most rewards are gone from the free version (albeit they had been sliding in value for awhile)

I mean the breakeven is… if you think you’ll hit the weekly $5 bonus for around 20 weeks in a year. And even then, that’s just significantly less rewards and value than before. It was probably too good to be true for a couple years there, hence the redesign, but it’s too bad. You could easily walk away with $200-$400 of net positive value a year with this card, but no longer a must have card.

Let’s hope they bring back some better ClimatePoint reward redemptions.

Update as of 12/31/25

I was given a standard promotional offer of $49.99 for FuturePass for a year. And I decided to take it. The easy math is that the $5 public transit bonus means I’ll break even with just 10 weeks of public transit usage, and that’s pretty doable. I’m not particularly interested in the remainder of the FuturePass benefits, but I’m sure I’ll review them through 2026. It’s still an overall disappointing step for FutureCard, but I’m still going to keep it rolling since it is worth just being my OMNY card / Metrocard replacement.

As of now, the ClimatePoint reward redemptions are still down, so no update on that front.

Never a fan of when companies suggest an extremely high potential maximum that isn’t particularly achievable for most users… $95 a month? Sure…

Full transparency, I have received 9 referrals as of December 31st, 2025! I’m honored. Thanks guys!