An Introduction to Credit Card Points

Skip To

Personal Finance Education is important

I have six rules to help me come out net positive

I have 7 active cards and another 6 “back up cards”

A KLM scheme gave me an effective cash back of ~4%, saving me over $2,000

An American Airlines redemption scheme gave me an affective cash back of 2.1%, saving me $380

With 3 FutureCard redemption schemes I saved over $400 with effective cash back rates of 61.25%, 13.05%, and 7.35%

References

Introduction

There are a lot of websites out there about this information. I thought I would post my own, not only because it may turn out to be useful to someone to share my personal, real, and unaffiliated experience and thoughts, but my debit card review of FutureCard is one of my highest visited pages, so I figure I should give the people what they want (though I think it’s because there weren’t really that many reviews out there for FutureCard, versus this is a very generic post). I’m always surprised when I meet people that don’t really think about how to optimize their credit cards or just don’t engage with the system for a variety of reasons.

I’m going to keep this on the basic end of the spectrum and hopefully it helps some newcomers learn how to best take advantage of the banks and credit card issuers. I have no qualms with trying your best to find a deal, banks and payment networks have plenty of money and can afford it. They’re not exactly friendly entities.

I’m going to go through some of the background, my rules, what my wallet has, and how I use points. As well as add some examples to show how I got great value. Hopefully you find some of it useful and interesting to set up your own wallet “regulations”. I won’t really go much into the premium credit cards or credit scores. I’ll save those for another time.

Background

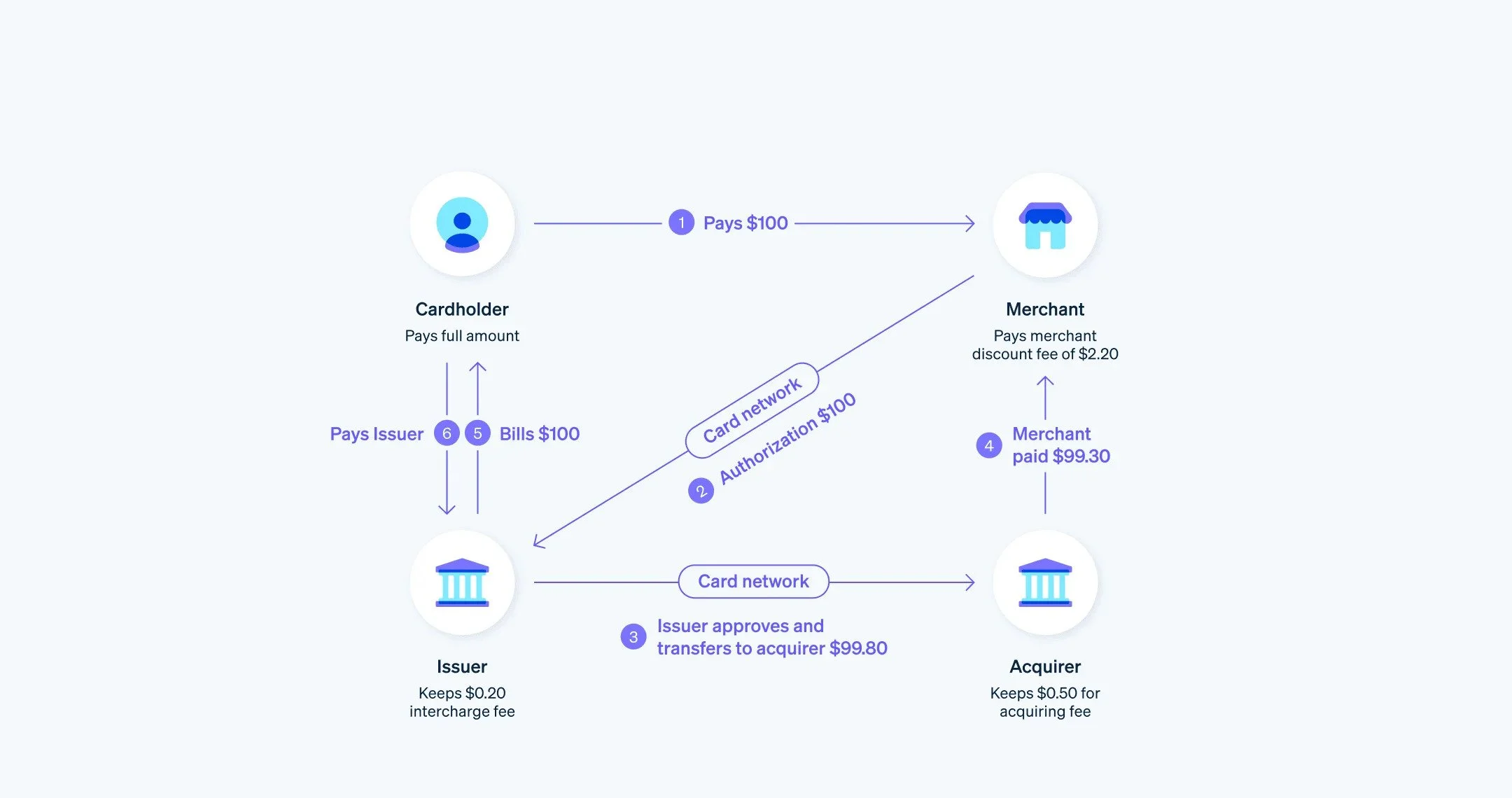

First, let’s start off with how transactions are done in our economy. There’s a lot more to this, but to quickly summarize, whenever there is a digital payment, a transaction network takes an interchange fee. Our entire credit card point system is built on this premise. Transaction networks want people to keep using their cards, so shops will keep paying the networks to have access to their customers. Think about it this way, if there are two local coffee shops with similar prices and quality, and one only took cash, are you more or less likely to go there? If they only accepted Discover cards… would you be more or less likely to patronize that business? That’s basically the whole business concept. Having access to Visa and Mastercard, who are the dominant networks in the US (American Express, JCB, and Discover only have a combined total of ~5% of the market), can be vital to businesses who want more customers.

Credit card transaction networks want you to use their cards, so they have (and this has sorta escalated and spiraled over the years) offered incentives, points, and rewards to get you to use them and in particular to get higher spenders to use them. This keeps the businesses “happy” to pay the transaction fees, because they know without them, they would have significantly fewer customers. The transaction fees are around 2.87%-4.35% (the interchange fee is the largest portion of this). It varies depending on card, network, bank, location, merchant, etc. There are complex messy formulas and negotiations that aren’t worth getting into. Here’s a link to just Visa in the USA, I mean, I don’t even understand most of it. All you generally need to know is that the networks charge more for fancier cards, because they are connected to “likely” higher spending individuals.

And so, to some extent either you or the business are paying for this cost somehow. You, as a credit card user, should be trying to get as much of the transaction fee back as you can. This has led to a whole world of cheapskates / game nerds (like myself) looking to maximize those points to recoup the interchange fee.

This also means whenever you pay cash (and there isn’t a sign somewhere that says they’re going to add the credit card transaction fee on separately if you pay by card) you’re actually paying for those transaction fee that’s baked into the price already. Therefore, it should be noted that this whole system is vastly predatory and takes advantage of lower income individuals far more, putting them in an ever-furthering difficult financial situation (while higher income individuals generally can earn value from the system). Even if poorer people don’t have a credit card, they’re paying for the rest of us who do. And those who do carry credit card debt, approximately 45% of American households, are paying interest that also pays for this whole system. For most merchants I’ve seen who add a transaction fee and pass that cost directly to the consumer seem to have a set amount, usually 3-4%, on the higher end of the spectrum. That would mean if you’re paying with a lower end credit card, you may be paying for the higher fee without the corresponding rewards. All the more reason to pay attention and try to maximize your rewards to try and counter this.

Let me be very clear, I would vote to reduce interchange fees a la the European Union that caps fees at 0.2% and 0.3%. Yes, this would likely tank this whole credit card points system, but that would be a positive sacrifice for the good of society. Although, the counter argument is that this does not necessarily bring prices down 1-3%, it simply becomes savings for merchants, but I’m more okay with merchants reaping the benefits. Besides, other schemes would inevitably pop up in the future that will keep us entertained. But, I digress, the system exists, and this is my post about a “fun” system and some personal finance advice / goals for other people to follow.

Credit Card Systems

Networks, like Visa and Mastercard generally make their money on the transaction fees.

Issuers, like the banks (think Capital One, Chase, and others) generally make their money on the interest and other fees.

Network Issuers, like Discover and American Express earn revenue from doing both.

Here are some quick estimated metrics on the three groups and how they earn revenue:

Networks

Visa earned 50-55% of their $36B total revenue in 2024 from the transaction fees

Mastercard earned $17.3B of their $28.2B total revenue in 2024 from the transaction fees, or 62%

Issuers

Capital One’s credit card division in Q1 2025 reported 70% of their revenue was from interest

Chase’s was similar around 60-65% of their revenue was interest

Network Issuers

American Express is a good example to view the whole system in one company since they do both main sides of credit card revenue, in 2024 about 60% of their revenue was through the transaction fees

American Express Estimated 2024 Revenue

While doing this research it should be noted that Visa had transaction volume ($6.4T) nearly 6x Amex’s ($1.1T). And yet, Visa only posted revenue of $36B versus AmEx’s $66B (these numbers change depending on how you define it, that’s why it differs from above, but for these general purposes, I’m just going to move on). However, the net income of Visa was $20B v. Amex’s $10B. Apparently, this can be explained that Amex charges much more for its transaction fees and spends much more on its operations since they have to do the rest of the credit card issuing expenses.

A few paragraphs back, I mentioned that credit card networks want you to use the card to make sure that the fees they are charging merchants are worthwhile (as in the transaction volumes they give them access to are valuable). American Express embodies this, despite having fewer transactions, they claim they’re from higher value individuals, and charge merchants more in fees (to access those customers).

Anyway, as you can see, the system generally makes money when users spend money. They are wholly incentivized to convince you to spend more. So, to incentivize you to use your card (as opposed to cash or another company’s card / network) they have added rewards systems behind it. Whether it’s cash back, points, miles, rewards, prizes, gifts, or statuses, they’re basically spending money on encouraging you to spend.

Credit Card Schemes

There are two main aspects to the credit card points system from a consumer perspective (I’m going to use the terms points and miles interchangeably, in my mind they basically are, just different names for these corporate currencies). You’ll earn points as a percentage of your transactions, and you’ll redeem those points for some amount of value. There are more complicated and advanced versions, particularly with airline credit cards and premium credit cards, but I’m going to skip those for this review.

I’m also going to rule out the alternative of cash at establishments that add in the transaction fee to credit card purchases. So even though cash is definitvely cheaper when merchants add on and pass through the fee, I find that with cash, I’m more inclined to donate the change, lose the change, round up the change, etc. and that adds up to more than the 3-4% added on merchant fee. Let’s just assume that credit cards are just the way we pay for things these days.

It’s important to recognize that a combination of both your earnings rate and your redemption rate becomes your effective cash back. This is vital because that blend is how you can compare your cards. Getting 3% earnings and 1% on cash back gives you an effective 3%, while earning 2% and redeeming 1.5% is also an effective 3%. Just because you redeem the points for more doesn’t necessarily mean you did better than a simpler and more boring cash back. The math can get a bit messy from here on out. Because you can’t really attribute an exact percentage of how much you got from a card based on each category without an excessive amount of effort, you’ll just have to create general earnings rates based on the card and how you use it.

Quick tangent. I hit a million “points” in July, 2025 (across all the different platforms I’m on, including One Key, which is a bit different, but I’m counting it). But basically, this is $10,000 in redemption value, albeit that will vary. A little bit in Accor and Hilton don’t mean much, versus the Chase points which are much easier to redeem for decent value. Plus I recognize that not all of these points are equal, but I don’t care enough to value each one specifically. The Wells Fargo one in black is actually Bilt.

Here’s a ten year look at how I’ve gained and spent rewards. This is just an estimate of how many points I have on hand any given month. You can see every jump up is probably a SUB or a big bonus / transfer. Every step down is a redemption or spend of some sort. Visualizing this and posting it online has me very critical of myself. And I’ll work on reducing this number as much as possible. There’s no reason I should have this many points. Shouldn’t let my hoarding mentality effect me.

Earning

Remember, every transaction you make earns the Networks money via the transaction fee. To encourage you to spend via their network / have a specific card, they’ve created this system to give you back some rewards. Generally, this is in the form of 1-5% back on the transaction. That “rebate” is often in the bank’s points, but can also be in an airline’s miles or a retailer’s currency or even simpler, cash back. It’s important to recognize all of these as different versions of that transaction rebate and think of them as just what percentage you’re getting.

Some cards focus on a base percentage return, but most have different return values depending on the category of spend. It’s good to get a variety of cards that give you access to these different and hopefully higher earnings rates as much as possible. The tradeoff is that it could take a lot of maintenance to keep track of them all. If you’re going to start anywhere, I would suggest a no fee 2% cash back card. That right off the bat gets you to a strong baseline, and from there you can add to it for specifics.

Redeeming

Some cards give you cash back, others will earn you points or miles or some other currency. These can usually be redeemed for cash, gift cards, things, experiences, travel, or transferred to another currency. Generally aim to have your redemption be at least 1 cent to 1 point. If any redemption option offers you less, it isn’t worth it in my opinion, find a method to increase that conversion or just burn that card down and don’t use it anymore.

My Guidelines

These aren’t, by any means, applicable to everyone or necessarily the right thing to do. This is just what I do. I assure you, if you follow these six-ish rules, you’ll come out net positive. Hopefully you find them somewhat helpful and spark some of your own ways to think of your own wallet.

This visualization was created using Gamma.app

Never carry a balance on a credit card

If there’s one thing that you should never do, it’s carry a balance on a credit card. By doing this and paying interest, it doesn’t matter about any of the schemes or points you do, it will never be worth it. The interest on balances range 10-30% (the average in November, 2024 was 21.47%) and generally rewards will only get you, at absolute maximum (and very rarely) 5-10%. You can see how if you pay interest you automatically lose…

Maybe this could be rephrased as, never treat credit cards like credit. They should only be treated like debit cards / cash, only spend what you have and can pay for. Never more. Don’t chase points and spend on things that you don’t need just because you want points. The most it should affect your spending is to put certain spends on certain cards, maybe at certain times, or do an alternative to a normal spend because of a particular bonus from a certain vendor / card. Do not increase your spending because of it.

Always set up autopay for the full balance to ensure that you never pay any interest by accident

It just saves yourself the headache and the loss if you ever forget to make a payment on time. Even if you overpay, it’ll be credited towards the following month, and even if you overpay and close the card, they’ll reimburse you (has happened to me and they just sent me a check to close out the account).

Try to earn at least 2% back on every transaction

This is my base goal on every transaction. There are a bunch of standard no annual fee cards that make this the absolute baseline. The one I have is the Wells Fargo Active Cash, but there are others like the Citi Double Cash.

Typically you can try to do better on certain categories that are popular. The common ones to aim higher for are dining, travel, utilities, streaming services, gas, groceries, etc. etc.

So having a card that gives you a higher earning rate per category that you spend a lot in is the core tenet.

Try to redeem for at least 1 cent per point (generally), if not more

This is just the current industry standard, but I suppose that may not always be the truth. Generally each point should be worth a cent, barring a few currencies that are valued differently. Go refer to one of the many articles like The Point Guy’s that create a valuation chart. However, keep in mind that their values are set at optimal amounts, that are highly specific and highly variable. Sure, you may be able to get those amounts, but if you weren’t planning on going to that place on those dates, then is it worth it? In my wise old age I’ve begun to value my preferences over just the best deal… not really, but it sounds wise. Anyway, get at least a cent for them if you’re getting cash back.

The best way I’ve found to create more value, is to transfer them for a bonus. Putting them into a pretty flexible airline when there’s an available bonus has been my best way to increase value.

My advice is to check out some rewards and test to see what flight options there actually are and how much they cost. A friend and I both made separate bad errors transferring points to Virgin Atlantic. The Virgin Miles for a flight between New York and London seemed cheap, but it turned out it would cost hundreds in taxes and fees, so it isn’t nearly as beneficial as we originally thought. London to New York is generally a relatively cheap flight, so paying cash for another airline flying the route turned out to be cheaper than doing it with points.

Also keep in mind most programs have an expiration date for points if you don’t actively use the platform, so be aware of that. If you move points to a network you don’t use often, there’s a risk they will be lost over time. You have to weigh the value of the limited time transfer bonus, with that potential loss.

The general rule is that premium seats (and upgrades to them) are the best value you can do compared to the retail price. While that may be true, it requires a lot of points, and I haven’t had much experience on that front. I’d rather get value today generally.

Burn points as soon as there is a decent deal

There are three reasons for this:

Inflation - all of these different systems often devalue their points or increase redemptions or add fees over time. It’s inevitable with that much liability sitting on their books, it’s an easy way to create value for their shareholders. Your points today will almost definitively be worth less in a couple years.

Interest - your points aren’t gaining interest, so convert it / use it, and get more of your money earning you interest. I mean in one year, based on the number of points I have, I’ve missed out on $300-$400 if I just utilized them to cover a basic Treasury Bill.

You’ll drive yourself mad trying to fully maximize every point, and kick yourself for not predicting offers and moves that you couldn’t have really anticipated.

That all said, I clearly hoard points all the time. Most of the time in fact. It’s tempting to try and create some extra value with a great transfer partner or special deal or specific trip. But the smart advice is that points are money, and you should be using it like it is money.

Never pay for an annual fee unless there’s an intro offer

This is a real personal preference. I just can’t justify the premium annual fees without the introductory offer or Sign Up Bonus (SUB you’ll see online). I just compare that with the points you can get for no fee cards, and it just doesn’t feel like that much of a benefit.

Let’s take the Chase Sapphire Reserve for a moment. Yes, it earns you 4x-8x on travel and 3x on dining, but only 1x on everything else. That means all of your other spending is actually earning half, and there are no-annual fee cards that get you 3x on dining, so it’s really only the travel component that you earn additional points on, and how much are you really going to spend on hotels and flights? Is that difference between that and 2% really going to cover the $795 $495 annual fee? Maybe?

That doesn’t mean you can’t make it work. If you travel a lot for work, or have strong loyalties to a brand, or care about certain upgrades / privileges, then a premium card certainly can make sense. But, for example, I just find that I drink alcoholic beverages I didn’t need to in the lounges, so I could just skip that at the benefit for both my health and my wallet. They often throw in a bunch of extra credits, like Dash Pass membership or a streaming service or exercise credits with Peloton or Soul Cycle. But, again, I wasn’t going to spend money on these, so they’re worth nothing to me. 12 months of Apple TV+ is nice, but I can watch what I want on Apple TV+ in a month or two, so while they claim it’s worth $250, it really is only worth closer $50 to me. That all said, I know plenty of people who make the premium cards work, because everyone’s math and spending are different.

I’ll do the math on a projected second year of the card (without the SUB), and usually decide to get rid of it. Depending on the credit card issuer, I’ll cancel the card before the end of the first year, or downgrade / convert it to a no fee card with that bank. You’ll have to call to do this, and some issuers will offer you a discounted annual fee to stay or only allow you to cancel after the first year (in which case they pro rata your fee based on when you do close the card), but generally it’s pretty easy to do.

My Wallet

Okay, so it’s good to have a diverse wallet that you can cover good earning categories with. Here are my six no fee staples. The top three earn points, the bottom three are cash back. Between these six, I’m earning a pretty solid base amount on rent, dining, public transportation, utilities, groceries, online shopping, and other rotating categories. Yes, half are cash back, but with a high earning rate, that is still a great effective rate, and way less maintenance and effort to achieve it. It’s good to note that these are fixed purchases, that can’t really be avoided, and I’m earning points on all of them. My rent, utilities, and subway rides are basically entirely required, and our weekly grocery bill and other online spend are covered as well. There can be other benefits to each of these cards, and sometimes more details, but this is a general broad strokes overview.

Bilt is just a must have for renters at this point. They’re probably going to nerf it in February, 2026 with the introduction of the new paid tiers, and redemption opportunities have already been dropping, but you can’t beat points on rent and 3x on dining for no annual fee. Considering no one else gives you points on rent, this is just free earnings for your likely largest single spend every month. They also do this earnings and redemptions bonus scheme on the first of every month, “rent day”, where you can earn more points for spend and get more value for your points (check out this website, and you can see all the rent day promotions for 2025, go to Reddit or somewhere to see previous years). This all adds up quickly and greatly. I’ve transferred points on two “rent days” with 63,000 becoming 141,750 KLM miles and 42,000 becoming 73,500 Alaska Airlines Miles. I’ve been a member for over 3 years now and that’s upwards of 100,000 free points for just preexisting rent spend.

If you join Bilt I get 2,500 points.

Chase Freedom (Flex) is a bit chaos and unreliable, but every so often it pops up being useful. So worth mentioning. It’s rotating calendar is odd, here’s 2025’s to give you a taste. I got Grocery Stores, Tax Prep, Amazon, Streaming, Gas Stations, and Select Live Entertainment back, and I’ll definitely do PayPal in December. These come in Chase Ultimate Rewards points, which can have a higher transfer / spend value than cash back depending on how you use them.

FutureCard is perfect for anyone in a city with public transit. I’m in New York City, so the MTA, Metro North, LIRR, and NJT all count towards 5% coverage. Add to that a $5 bonus for hitting the weekly subway cap and 5% back on Utilities, and this is easy pickings. Here’s my deep dive review of it. A lot of the other aspects that were great about it have been cut in recent months, with higher spending requirements and harder to hit bonuses, but it’s still a solid card, especially since all funds on it gain a 4% interest rate currently.

If you join FutureCard I get $15.

Citi Custom Cash can have one of the following categories set at 5% earn, we go with Groceries because it fits our typical spending habits, complements the other cards, and is highly consistent:

Groceries, Select Travel, Restaurants, Home Improvement Stores, Gas Stations, Live Entertainment, Select Transit, Drugstores, Fitness Clubs, Select Streaming Services

Wells Fargo Active Cash has a standard 2% cash back on everything. Nice when you can’t be bothered to figure out which is the right card to use, you know at least it’ll be a standard 2%. Citi Double Cash also achieves this, as does Fidelity Rewards, Synchrony Premier World, and US Bank Smartly. So, explore all of them to see if it fits you.

I have to thank my brother for getting me into Bank of America Customized Cash Rewards. Setting this for Online Shopping is critical for this day and age. 3% standard back just is a breeze and no brainer.

Only three of these have referral codes, the other’s you’ll have to go to their page, and in an effort to promote the ones I may actually get something for, I’m going to force you to Google the Citi Custom Cash, Wells Fargo Active Cash or one of the other cash backs, and Bank of America. Most of these cards have very minimal SUBs, so that doesn’t really matter here.

If you join Bilt I get 2,500 points.

If you join FutureCard I get $15.

In addition to these, I usually have a travel card or premium card, that I focus travel spend on. Just make sure that I’m getting no foreign transaction fees, and some benefit for Hotels and Airline spend. These are the ones that I typically only open for a year. Take a SUB and move onto the next. There seem to be enough out there that I can keep rotating without an end in sight. Right now, I’m doing an American Airlines card, prior to that the most recent ones were Citi Strata, BoA Premium Rewards, and KLM. I’m not a full intense churner, I open 1-2 cards a year.

On top of that, I technically have 6 more no fee credit cards that just kind of sit around and don’t do much of anything. I’ll throw a spend here and there, depending if there’s a specific benefit. These include:

X1 (legacy from when it was great)

Capital One Venture One (a no fee downgrade from the VentureX)

Chase Freedom Unlimited (my oldest original card)

Chase Sapphire (a no fee downgrade from the Reserve)

Schwab Investor (an old legacy one to make sure I have an AmEx)

Apple card (free, looks cool, only really good for when I need to buy something from Apple)

I think that means my wallet is 13 cards… but I really only use 7.

Specific Examples of Good Earning

These are less fun, but it’s worth pointing them out. Most of the credit card platforms have a Merchant Offers section. They often look quite similar, below are Chase, Bank of America, and Citi Bank.

They’re clunky and hard to follow, but it’s worth checking in on every so often, because there are usually hundreds of offers, that you need to actively add / turn on, to earn. You may be happening to use one of these right now or were going to go to a competitor, and maybe this could swing you towards them. 5% back on Lyft is a good one to use. 10% at Chipotle is definitely handy. Most are garbage and should be ignore, but you never know what might pop up that could be worth it.

Specific Examples of Good Redeeming

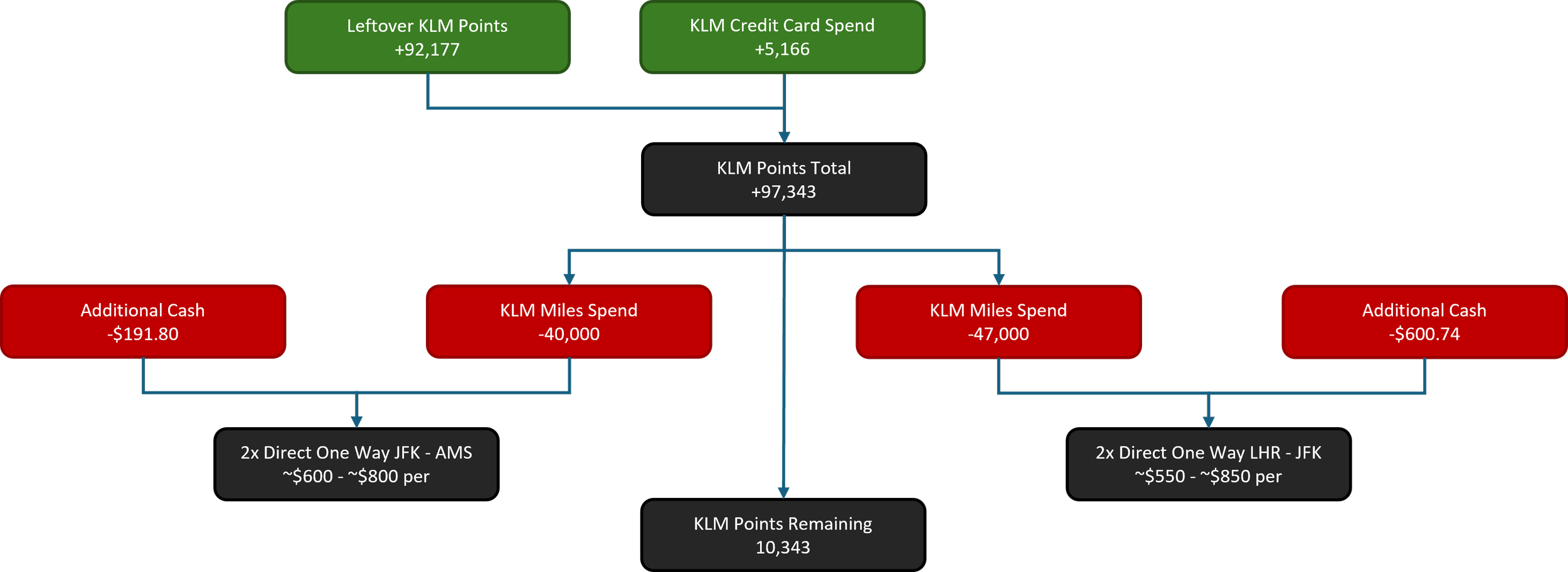

KLM was probably my greatest credit card success (so keep that in mind, that I typically never get this value). Knowing we were headed to Amsterdam for Taylor Swift’s Eras Tour, I got Bank of America’s Air France KLM World Elite and its intro offer of 50,000 miles at the time. Then I got very lucky with the Bilt card offering a transfer bonus of 1:2.25 to KLM on 1/1/24. Therefore, I fortunately converted 63,000 Bilt points into 141,750 KLM miles. I ended up with 196,177 before spending 104,000 on two one way direct flights from New York to Amsterdam and two one way direct flights from London to New York. This broke out to 58,000 miles and $128.80 for the Amsterdam leg and 46,000 miles and $535.20 for the London leg. Here’s a little diagram I made to make it easier to explain.

Essentially 4 flights that should have cost me at least $2,300 only cost me $1,704 (including both points and cash spend). Let’s take that estimated value of $2,300 (that’s pretty conservative, but best to do the math this way) and subtract the fees I had to pay on the flight (-$664) and the amount the 104,000 miles covered was $1,636. That’s a redemption rate of ~1.57 cents per mile. Better than the typical redemption standard of 1.

The next level of math gets a tad more complicated, but it can really demonstrate where you can show the full picture. As a caveat, I’m going to consider all credit card spend to earn those points, as normal spend I would have otherwise done. Let’s start by considering all the spend to earn that 4,427 miles, which would have been around $4,427 since this card only gets you 1% on purchases. Considering I preset the minimum target goal at 2%, using this card cost me $44.27 or 1% of that spend (since I got less than 2%). The Bilt card gets me 1% on rent, and categorizing that as a fixed cost and I wasn’t getting any alternative points on that at all, I’ll consider the earnings goal on that as 1%. But I did pay an $89 fee for the KLM card. That means my total additional cost was about $763.27 ($44.27 in lost earnings + $89 in the credit card fee + $630 of Bilt points) to generate 196,177 miles. That’s an earnings percentage of 2.57% (though we have to keep in mind that at the start, I didn’t know I was going to get such a stellar transfer bonus from Bilt to KLM).

That means my effective cash back under this scheme was 4.04% (combining the Earnings Rate and the Redemption Rate). Which is really impressive when you consider most of those points were earned at a 1% rate).

And… it just so happened we were headed back to Amsterdam again the following year for a wedding. So, here we go again!

Quickly, the same math. 1.73 cents in redemption ($2,300 - $792.54 = $1,507.46 / 87,000 miles) and 2.47 cents in earnings (same math as before, but adding an additional $51.66 which is the additional KLM spend for this period), for a total effective cash back of 4.28%.

Let’s look at these results some other ways. Over these 8 flights I saved at least $2,328.53 (the market value of $4,600 - $814.93 (fees, Bilt points, lost earning by being below 2x) - $664 (fees on the first set) - $792.54 (fees on the second set)). That’s an ROI of 102.51% (Gain of $2,328.53 / $2,271.47 (all spend)). And if I consider those Bilt points free, which an argument could be made that they are, I actually saved $2,958.53.

This is a pretty extreme example, and I do not expect to get this level of redemption often, but it demonstrates how much value there can be in this whole system.

It should be noted that the Bilt transfer to KLM was the real cause of the big winning here. This is why often the maximum value you see quoted is unrealistic, you sometimes just have to get really lucky. Without this bonus, the total effective cash backs would have been 1.99% - 2.18%, the savings would have been $1,541.03 and the ROI would only be 50.38%.

2 preplanned and purposeful trips to Amsterdam made this a highly useful, but rare situation. It should also be noted that we flew back out of London Heathrow which was much cheaper than out of Amsterdam, so another point where a maximum redemption situation requires flexibility on your plans. We like London and can even work remote there for a few days, so it is a pretty easy place for us to get to and spend time in (and I’m going to advantageously ignore that technical additional cost).

Also, let’s be honest, I sorta made up that math as I went, so if there’s any flaw to that logic, please feel free to call me out on it. I did it this way because it felt simple and logical to me, but I’m no expert, so I’m always happy to learn.

Here’s an alternative and much more standard redemption. Typically, domestic airline fees are much lower. 2 round trip tickets from LGA to GSP (Greenville, SC) had fees totaling $22.40. And they cost 38,000 American Airlines miles. The retail value is about $420. This is a 1.05 cent redemption rate, a savings of $17.60. Pretty standard, not much better than cash back, the great value comes from the fact these points were all earned on no fee cards and at least a 2% earnings rate. That’s a total effective cash back of 2.1%. And an argument can be made this was just 4 flights for an additional $22.40 and this whole system gave me back $380 via American Airline miles for no real reason, other than the effort to do it.

If you want some more redemption stories, check out this other post on the FutureCard and some redemptions I’ve had on that card. Hans Zimmer for 12.25 cents per point, Bathhouse for 2.61 cents per point and CitiBike for 1.47 cents per point. And I generally get a 5% earnings rate on all my spend in FutureCard. that really means… I was getting an effective cash back of 61.25%, 13.05%, and 7.35% for each of those schemes. The former is a bit of boohockey since it was a pretty extreme example, but still the other two are solid returns.

Conclusion

Even at a no fee standard 2% earning, the credit card companies are still winning. But we’re paying these costs as part of our system almost all the time, so it’s worth doing because it’s fun, and it’s essentially / technically free to gain some extra value. While redeeming for these big travel rewards can be enticing and feel great, don’t overlook just straight 1:1 cashback at high earning percentages. It’s way easier, more reliable and consistent, and can be just as worthwhile for your wallet. That said, if you have a lot of time to try and optimize / are a high spender / value travel upgrades / lounges / and other travel benefits, there can be lots of opportunity for increasing your impact with the same spend. But don’t let people tell you that the travel / mileage transfers are the only way to do points, good cash back can be equally as valuable.

If you’re looking for a credit card to open, I highly recommend Doctor Of Credit, these guys are basic and less fancy than the other websites, but they also aren’t as heavily affiliated and biased as them either. Also, after posting this article, I watched this YouTuber, Daniel Braun, and he does a good review of the recent updates of credit cards, that basically aligns with my same advice. So I feel pretty validated.

Here are my referral codes in case you want to go that route too! It all supports the website, I’d love to be able to pay for the annual subscription fee with Square Space someday!

If you join Bilt I get 2,500 points.

Updates (11/7/25)

Just a couple of updates that I want to add post publishing.

FutureCard has yet to have a good redemption in 2025. I think they’ve caught onto the fact that they were allowing people to redeem for far too much value and they’ve even made it much harder to hit bonuses by requiring a minimum number of transactions (typically 3) with a vendor.

Virgin Points (for Virgin Atlantic) are just terrible. I had the ability to transfer from Citi Thank You Points to Virgin Points for a 30% bonus, converting 58,000 to 75,400 and thinking that New York to London would be a reasonable option in the future that these would pan out. However, with huge taxes and fees required to be paid in cash and highly limited partner airline options with Delta for domestic flights, I’ve found them to be a hugely disappointing currency with a lot of limitations. I would recommend you avoid this program.

References

https://www.fool.com/money/research/credit-debit-card-market-share-network-issuer/

https://upgradedpoints.com/credit-cards/us-credit-card-market-share-by-network-issuer/

https://squareup.com/us/en/the-bottom-line/managing-your-finances/credit-card-processing-fees-and-rates

https://www.clearlypayments.com/blog/interchange-fees-by-country/

https://www.nerdwallet.com/article/credit-cards/credit-card-companies-money

https://www.fool.com/money/research/credit-card-company-earnings/

https://s26.q4cdn.com/747928648/files/doc_financials/2024/ar/v2/American-Express-2024-Annual-Report.pdf

https://s29.q4cdn.com/385744025/files/doc_downloads/2024/Visa-Fiscal-2024-Annual-Report.pdf

https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_MA_2024.pdf