One Thing You Should Know About Bilt 2.0

Background

There’s a billion articles on Bilt 2.0 (Bilt’s transition away from its issuer, Wells Fargo, of almost 4 years and its redesign of its credit card(s)). Most have article headers claiming to tell you everything you need to know about it. But I wanted to add my two cents since I dove into this deeply on this snow day, and before the selection date ends next week on January 31st and the new cards arrive on February 7th. So, I’m really just going to tell you one thing about 2.0. The new Bilt cards aren’t for earning points on rent. I’ll explain further in the second section, but if you don’t read anything else, just walk away with that talking point.

If you want a better background on the program go to the official website or Reddit. Preferably the latter gives you a great quick overview. And if you’re looking for a video summary, Daniel Braun is one of my preferred YouTubers on the category. Anyway, I spent a good deal of time today trying to figure out the math, because I found the wording and structure needlessly confusing. The key is that Bilt is constantly reiterating that they will not charge you for the rent transaction fee, but if you want to earn points on the rent expense then you have to hit certain goals. It may be simple to most people, but it took me awhile and I’ve finally figured it out, and I just want to share the answer to perhaps save someone else the frustration.

I’ll start by saying that Bilt “1.0” was simply too good to be true and I don’t blame them for resetting and redeveloping the program. It is estimated that Wells Fargo was losing around $10 million a month (according to a WSJ article in June 2024). That is on top of the $60 million investment Wells Fargo made in the company along with Mastercard and other investors in 2021 when they partnered. The main problem being that there is an actual fee Bilt / Wells Fargo were “eating” when people were using the card to pay for their rent. Add to that low interest income, high user acquisition cost, high reward costs, misjudged spending habits, and unrealized cross-selling, and it was just a financial disaster. So, I’m not sure why people are so upset? It’s a company, and it’s losing money. Either it shuts down or it reinvents itself. Great that many people got to take advantage while they could, but it simply couldn’t last forever. Grow up and stop complaining.

Sidebar throwback, remember when they ended Point Quest? It was a monthly speed round trivia game that you’d get 400-600 points depending on your performance. Easy fun, and was replaced by the silly Rent Fee Family Feud game that I stopped paying attention to because I have little interest in influencers (and I, nor anyone I know, have ever received any of the rewards / Bilt points for participating).

The Weird New Rent Math

What’s odd and the main reason why I wanted to post is that their main schtick, getting points on rent, seems to have been nerfed. In Bilt 1.0 they only required 5 transactions a month for them to give you points on your rent payment. Some people would do just the minimum, but even the rest of us (I guess as a whole member base) didn’t do enough to earn Bilt / Wells Fargo enough revenue. In 2.0 they have two different concepts they’re allowing you to pick from. Both of these will allow them to earn much more on fees and hopefully balance their books. I suppose only time will tell. (oh, also, apparently Bilt has expanded to mortgages, so when I say rent, it really should be housing costs, but saying rent just feels easier to me, so I’m going to stick with it).

Option 1 is a different earnings rate on rent based on how much you spend on non-rent.

You earn 1.25x Bilt Points on rent if you spend over 100% of your rent in non-rent spend

If you spend only 75% you get 1x, 50% is 0.75x, and 25% is 0.5x

You get 250 points if you don’t spend any additional amounts

Option 2 is earning 4% on non-rent in a new currency called Bilt Cash.

To earn the full 1x on your rent, you must pay to “unlock” those points at a rate of $30 of Bilt Cash for 1,000 Bilt Points, up to the total of your rent

Again, if you choose to not unlock the points, you’ll get a 250 point minimum

Option 2b is just that. Take the 250 point minimum, and instead of spending Bilt Cash on the transaction fee, you simply don’t earn the full points on the rent payment and therein lies the surprising problem. This is a better value. To opt out of their main scheme, you’ll earn more.

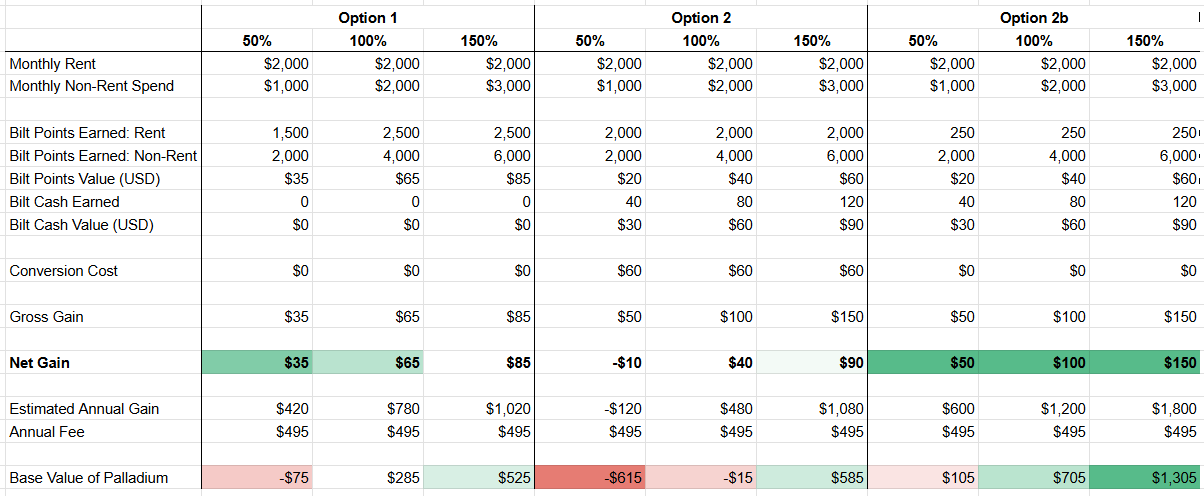

Here’s the math. This is set with the Palladium card in mind.

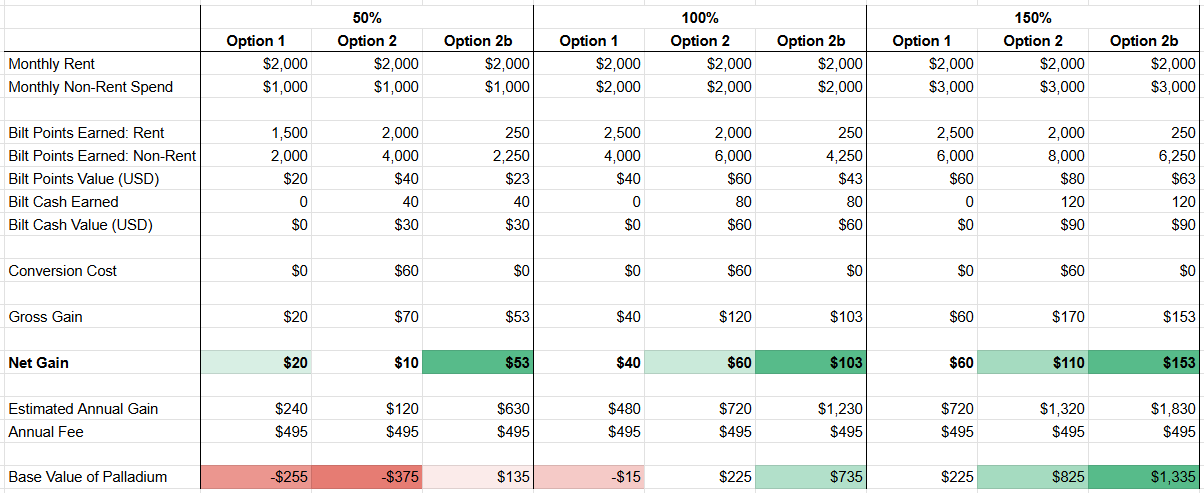

Let’s say you spend $2,000 on rent (and you can change this number to whatever yours is since the schemes are based on whatever your rent number is and I’ve also done it at $1,000 and $3,000 to show you the difference, or lack thereof). The first series is each option, then broken down by the amount of non-rent spend. The second series is split up by how much you spend in addition to your rent on the Bilt card, and then by the three options. Two views of the same data to help you consume it.

Now I’m valuing Bilt points at 1:1 for US Cents. This is underselling them, TPG currently values them at 2.2, but if you have read my other posts, I’m much more conservative since I think those valuations are far too optimistic and aren’t fungible enough to truly be redeemed at those idealistic rates. It’s far too early to tell about Bilt Cash, but I’m going to start them at 0.75:1. I’m not particularly a fan of the limitations where you have to spend them in small amounts periodically. It makes it significantly more likely you’re spending on something you weren’t otherwise going to. Obviously, that’s their goal, but it shouldn’t be yours.

If you are spending less, then Option 1 is solid. If you’re spending more, Option 2 becomes better. However, it is also pretty obvious that Option 2b gets you the most value back regardless of spend.

Just take Option 2B compared to the others. It is earning on average >2.5 times more. And if you spend more on non-rent categories with the card, the more you’ll earn back.

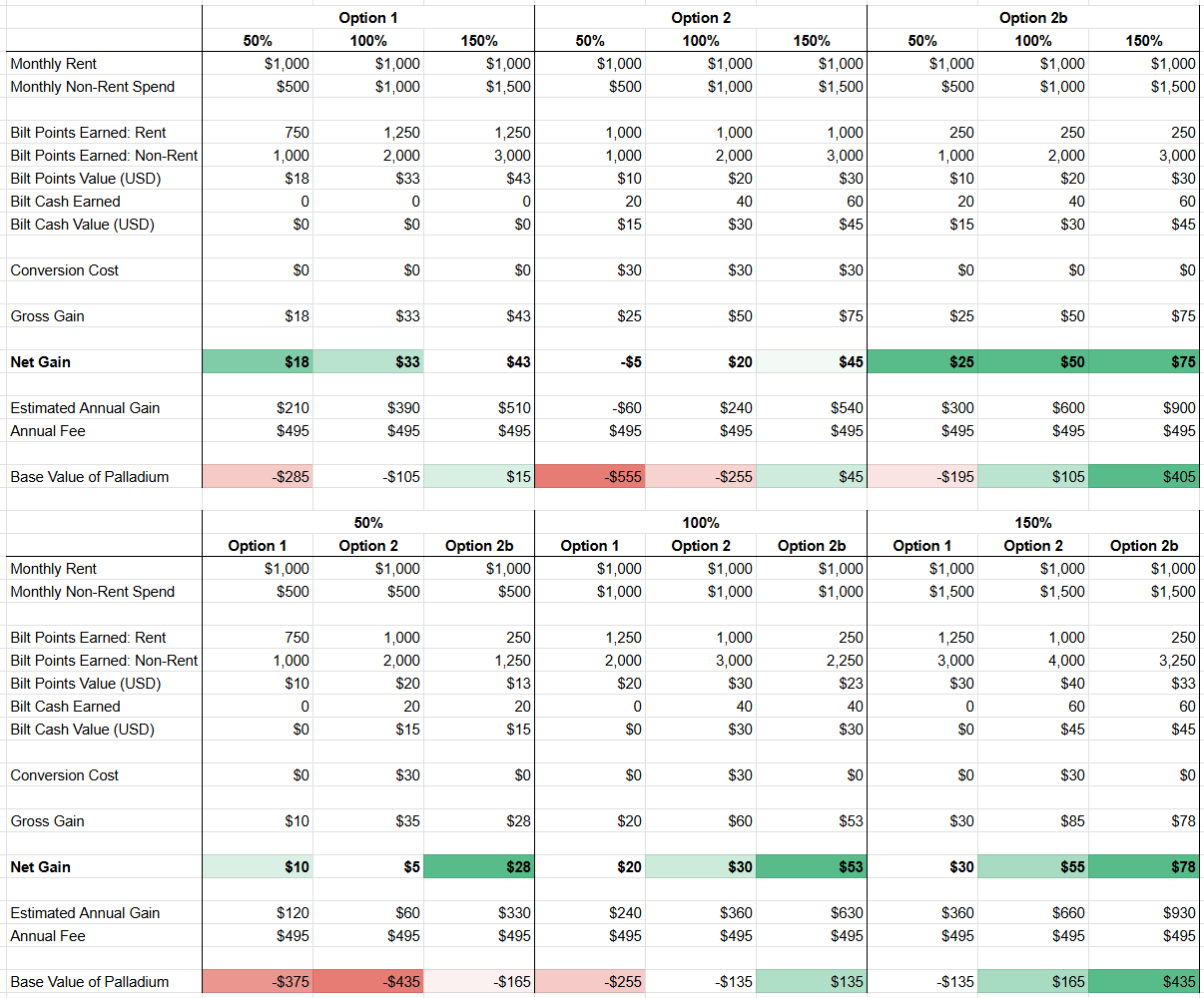

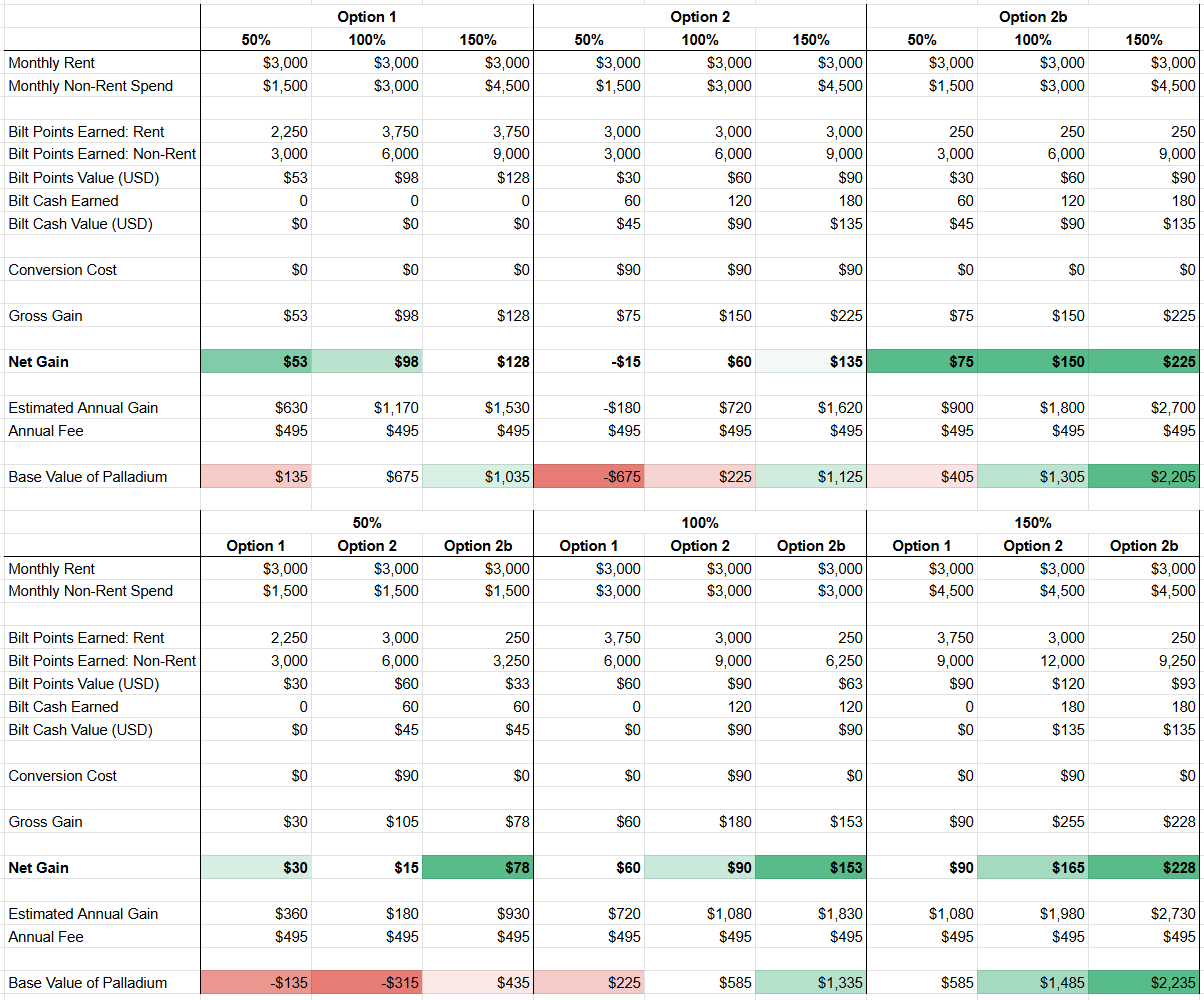

If you really care about seeing it. Here’s it all again if you have a Monthly Rent of $1,000 and $3,000. And as you can see, at the very least, if you put your rent on the card, you should at least match your non-rent spending to the rent amount to get a semblance of good value back.

In conclusion, if you simply spend a lot on Bilt, you’ll be healthily profitable. But at the end of the day, the best value is in not caring about getting the points on your rent…

By skipping rent points, you keep 4% Bilt Cash on all other spending, versus you converting some of that 4% Bilt Cash at 3:1 to earn your rent’s Bilt Points at 1% of your rent.

You would literally be trading $30 for $10 if you wanted to unlock the points from rent spend.

Now that math is accurate if Bilt Cash is worth 1:1, which I doubt it technically is, so it’s probably slightly closer in reality, but the general logic stands: it’s currently not worth trying to go get the full value of the points your rent is earning. e.g. if you earn 30 Bilt Cash, you can keep it and it’s probably worth ~$24 or convert it into Bilt Points worth $10 (1,000 Bilt Points). Even if you value Bilt Points at 1.5 or 2.2, then $15 or $22. Still less than what the Bilt Cash is conservatively worth… so… why put your rent on the Bilt card anymore? Like there just isn’t a reason other than that you can?

The next debate is, could you have gotten more points for that spend with a different card(s)? And if you don’t spend on non-rent as much as your rent payment is, you’ll be barely breaking even.

What I’m Doing

As you can see by my card… this was a go to staple of mine for years. It’s pretty worn out. 3x on dining was pretty clutch. Food & Beverage is one of my largest spend categories. Combined with the rest of my wallet, I had a pretty good system going. Losing that means I’m going to have to drastically rethink things this year and find a new one to fit that category. Between that and the rent, over the past 4 years I earned at least $3,500. Broken out as two transfers at 63,000 (2.25x at KLM) and 42,000 (1.75x at Alaskan), and a remaining ~141,000 current Bilt Points. $3,500 for a card I have paid zero fees or interest for is a pretty great value… but probably why Bilt and Wells Fargo have struggled.

I’ve selected the Palladium, in hopes that this year I’ll be able to find a great transfer partner or redemption for my points. I’m expecting the value to certainly drop this year, but I’ve got a lot already in the ecosystem, so I’m willing to let it roll for 2026. With an existing 141,000 Bilt Points and the additional 50,000 intro offer plus the necessary minimum spend of $4,000 (earning at least another 8,000 points), I should have at least 200,000 to transfer. Hopefully I can find a 1:1.5 bonus deal at some point. It sounds like Bilt Cash will be able to boost transfer bonuses which could come in clutch. My goal is 300,000 miles for an airline so Mattos and I can fly somewhere for a deal. Preferably Atmos, United, or KLM. Those feel like the best value / easiest for me to use. Just an obligatory reminder that Virgin Airlines Miles kind of suck (at least I’m having difficulty redeeming for a good value).

I’ll reassess at the end of the year. Though rumors sound like that downgrades won’t be possible, so it seems most likely I’ll have to just cancel. No hard feelings Bilt. It was a profitable ride, but you’ve gotta find a way to make your operations sustainable and I’m going to hunt for the next deal.

I’m going to take Option 2b. Commit to spending on the card. And… we’ll see how it goes.

Rest in peace Bilt 1.0, you served me well. Enjoy retirement.